If you have a $500 deductible, you pay $500, after that your car insurance business pays the remaining $6,500. When do you pay a deductible for automobile insurance policy?

: covers damage because of reasons besides crash, including theft, criminal damage and fire - low cost. An uninsured/underinsured driver insurance coverage case might have an insurance deductible, depending on where you live. Uninsured driver protection deductibles tend to be regulated by your state rather than you picking the quantity. Auto responsibility insurance covers damages and injuries you trigger to other individuals or their residential property.

Do I pay a deductible if I'm not at mistake? If you are in a collision that is not your mistake, you usually won't pay a deductible.

You will certainly need to pay your deductible in this instance, yet if it's later located that you're not at fault for the crash, you can obtain a reimbursement. There are a couple of other opportunities that might occur: Your insurer might decide to go after action versus the various other motorist's carrier to redeem their expenses.

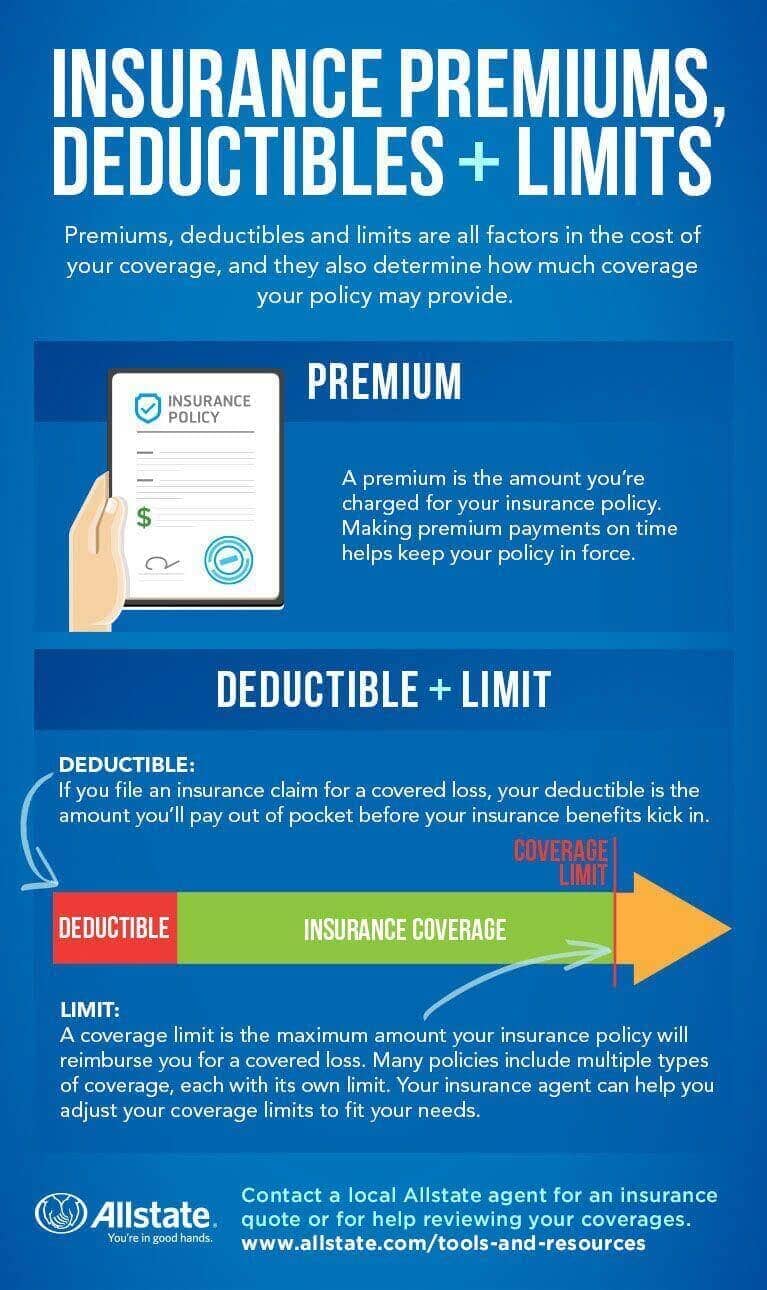

If you are not able to recoup your insurance deductible from your supplier, you can take the other chauffeur to tiny claims court for the insurance deductible amount. Maintain in mind, nonetheless, that the deductible quantity might not worth the moment. insurance companies. Car insurance deductible vs. premium Deductibles and premiums are two sorts of repayments you make to your automobile insurance policy business for insurance coverage.

Exactly how high should my deductible be? The higher your cars and truck insurance coverage deductible, the lower your costs will be (cheap car).

Not known Details About What Is Car Insurance Deductible? How Does It Works - Way

cheapest auto insurance auto auto https://car-insurance-albany-park-chicago-illinois.s3.che01.cloud-object-storage.appdomain.cloud/index.html dui

cheapest auto insurance auto auto https://car-insurance-albany-park-chicago-illinois.s3.che01.cloud-object-storage.appdomain.cloud/index.html dui

If you have sufficient cash to cover a high insurance deductible in case of a claim, you ought to go that path. This aids keep your annual costs low and also may possibly save you a great deal of cash over time, particularly if you do not need to submit a case - business insurance.

This is due to the fact that the worth of your auto could be around what you would certainly have to pay out of pocket in case of a claim, making a high deductible cost excessive. You can usually pick from a range of deductible amounts. There are also some vehicle insurance policy policies without insurance deductible, but they're so costly that they're frequently not worth it.

Our own research study reveals that there isn't a significant effect on your premium once you pass by a $750 deductible, so think about keeping your deductible amount between $500 as well as $1,000 (cheaper). It should be noted that if you fund or rent your vehicle, you might not have an option in the insurance deductible on your auto insurance coverage.

LLC has actually made every effort to ensure that the info on this site is right, yet we can not guarantee that it is totally free of inaccuracies, mistakes, or omissions. All material as well as solutions supplied on or via this site are offered "as is" as well as "as offered" for usage.

Your cars and truck insurance policy deductible is usually a collection amount, claim $500. If the insurance adjuster establishes your claim amount is $6,000, as well as you have a $500 deductible, you will certainly get an insurance claim payment of $5,500. Nevertheless, based on your insurance deductible, not every car accident warrants a claim. If you back right into a tree causing a tiny damage in your bumper, the expense to repair it might be $600.

Deductibles differ by plan as well as vehicle driver, as well as you can select your cars and truck insurance policy deductible when you purchase your policy - cheaper cars. It's necessary to consider deductible options when you compare car insurance coverage to see which is your best choice. Vehicle drivers searching for the most affordable vehicle insurance should enhance deductibles when they're getting a quote, yet they must additionally realize they might have to pay more money out-of-pocket in the occasion they make a case.

The Of How To Choose Your Car Insurance Deductible (2022 Guide)

Compare quotes from the leading insurance coverage firms. Which Car Insurance Coverage Coverage Kind Have Deductibles?, there are varying deductibles based on those different types of coverage.

This insurance coverage pays for repair services to your lorry when you are at fault (insure). This can be when your vehicle is damaged in an accident with another lorry or an item such as a tree or wall surface. This deductible is typically the greatest insurance deductible you will have with your cars and truck insurance coverage policy.

Because case, you would not pay an accident insurance deductible. Accident security insurance coverage pays the clinical expenses for the driver as well as all guests in your vehicle. cheaper car insurance. Without insurance motorist coverage pays your expenses when you remain in an automobile crash with a vehicle driver that is at fault but does not have insurance coverage or is insufficiently guaranteed to cover your prices.

cheapest auto insurance cheap auto insurance affordable auto insurance prices

cheapest auto insurance cheap auto insurance affordable auto insurance prices

What Is the Average Insurance Deductible Cost? Because customers pick differing kinds of automobile insurance policy protection with various monetary limitations, deductibles can vary significantly from one driver to the following - liability. For most chauffeurs, regular insurance deductible amounts are $250, $500 and also $1,000. According to Cash, Geek's information, the typical auto insurance coverage deductible quantity is approximately $500.

Your automobile insurance policy deductible will certainly vary based on that coverage as well as the price of your costs. Generally talking, if you pick a policy with a greater deductible, your premium will be lower. This can be an excellent alternative as long as you can pay that greater insurance deductible in case of a mishap.

Understanding Auto Insurance Can Be Fun For Anyone

You can save a standard of $108 per year by boosting your insurance deductible from $500 to $1,000. For those with limited budget plans, selecting a reduced premium as well as a greater insurance deductible can be a way to ensure you can pay for your car insurance coverage (auto insurance). Nevertheless, if you can manage it, paying a higher premium might imply you don't need to create a great deal of money to pay a reduced deductible in case of a crash.

It is very important to have your concerns pertaining to vehicle insurance deductibles addressed prior to that happens, so you know what to expect. car. Increase ALLWho pays an insurance deductible in an accident? Do you pay if you're not liable? When there's an automobile mishap, the at-fault driver is required to pay the automobile insurance deductible.

If the at-fault vehicle driver does not have insurance or sufficient insurance to cover the other motorist's expenditures, the no-fault driver can use his car insurance coverage as secondary coverage to pay the expenses. When do you pay an insurance deductible if you are needed? Typically, if you are called for to pay an automobile insurance coverage deductible, the amount of the insurance deductible will certainly be subtracted from your insurance claim repayment when it is released.

Can you prevent paying an insurance deductible? Essentially, the only method to stay clear of paying a cars and truck insurance deductible is not to file an insurance claim.

Contrast quotes from the top insurance firms. Key Information Concerning Vehicle Insurance Deductibles, If you have car insurance, you will need to pay an automobile insurance deductible when you submit an insurance claim for repairs and also injuries. Just how much you pay for your insurance deductible depends upon your automobile insurance coverage as well as just how much your auto insurance policy premium is.

low-cost auto insurance car insurance affordable risks

low-cost auto insurance car insurance affordable risks

The at-fault chauffeur in the mishap is generally required to pay an automobile insurance policy deductible. Obligation insurance coverage does not need an auto insurance deductible, but just covers the expenses of the various other motorist, not your own - vehicle insurance. Concerning the Author.

The Ultimate Guide To What Are Auto Insurance Deductibles & How Do They Work?

Insurance deductible defined An insurance deductible is an amount of money that you on your own are responsible for paying toward an insured loss. When a disaster strikes your house or you have an automobile mishap, the amount of the insurance deductible is deducted, or "deducted," from your case settlement. cheapest car. Deductibles are the method which a risk is shared in between you, the insurance policy holder, as well as your insurance company.

An insurance deductible can be either a details dollar quantity or a percentage of the overall amount of insurance coverage on a plan (risks). The quantity is established by the terms of your coverage and also can be located on the statements (or front) page of standard house owners and also vehicle insurance policy policies. State insurance laws purely determine the way deductibles are incorporated right into the language of a policy and also exactly how deductibles are carried out, and also these laws can differ from one state to another.